Nam Tai (NYSE: NTP) - Probability Analysis

Does IsZo actually only have a 1 in 4 chance of winning?

Date of Publish: 11/01/2022

Name: Nam Tai (NYSE: NTP)

Market Cap: $380m

Current share price $9.70

The company:

NTP is a property developer in the rapidly expanding city of Shenzhen, which is on main land China, right next to Hong Kong.

If IsZo gains on-shore control of NTP, we believe the shares are worth between $20 to $40, and expect them to trade in the range they were trading before the forced selling occurred in December.

What to expect

This analysis covers a probabilistic approach to analysing the current binary situation with NTP and IsZo Capital’s battle to control the company, after winning an off-shore legal battle.

This is not a stock pitch. We have simply used this analysis to aid us in this particular investment, along with all the other due diligence we have carried out.

We will present, what we think the current share price implies about the probability of IsZo regaining control of NTP (which would be a very positive outcome); and the probability of Kaisa retaining control despite off-shore court ruling (a very negative outcome).

This analysis works in a similar way to a reverse DCF, so that with very few anchoring assumptions, we can look at what the market price is implying, and thus decide for ourselves if it seems reasonable or not.

I.e. in the same way as looking at a reverse DCF and saying, well the market is implying earnings growth of 80% per year, for the next 10 years; we think it can do 20% at best per year; so the share price is clearly too expensive (action: go short or no action).

We can use the same principle to look at what probability the market is currently assigning to the event that IsZo does take full control of NTP, based on the current share price and assumed NAV of the properties, and see if it sounds reasonable or not.

The overall investment thesis has been covered in some depth by a number of excellent analyst and so we have included links to some articles in the appendix. However, background isn’t essential in understanding this analysis.

Analysis

Assumptions:

If IsZo gains on-shore control of NTP (and the illegal CEO hasn’t done too much damage. We assume he hasn’t decided to demolish all the existing buildings and allow for the fact that there may be some unrecoverable cash stolen or misused up to a maximum of $80m.)

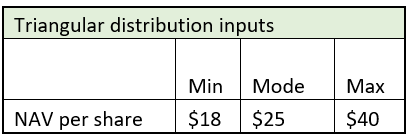

We assume a triangular distribution (‘lack of knowledge distribution’) with the follow inputs for our Net Asset Values, which we believe are conservative estimates.

Triangular distribution inputs

The NAV is based on several independent reports. There are more recent reports on the land value, however the most recent economic (land plus rental value) valuation report was carried out in 2017. We are conservatively basing our estimates on these, despite the rapid price increase that has occurred in Shenzhen since then.

The analysis isn’t that sensitive to NAV assumptions and we give a less prudent but still realistic scenario later on.

Expected probability of IsZo gaining full control:

So we don’t want to make a prediction on what we think the odds are of IsZo winning, We just want to find out what probability we would need to use, to arrive at the current share price of $9.70, given the possible NAV outcomes assumed above.

We use a Continuous Uniform Distribution to model the success of IsZo. When multiplied by the Triangular distribution above, it gives the expected value for that outcome.

We use a Uniform Distribution of (0.1, 1.1) to ensure there is a floor in the resulting share price of c. $3, which is lower than Covid lows. We think this is the worst possible outcome.

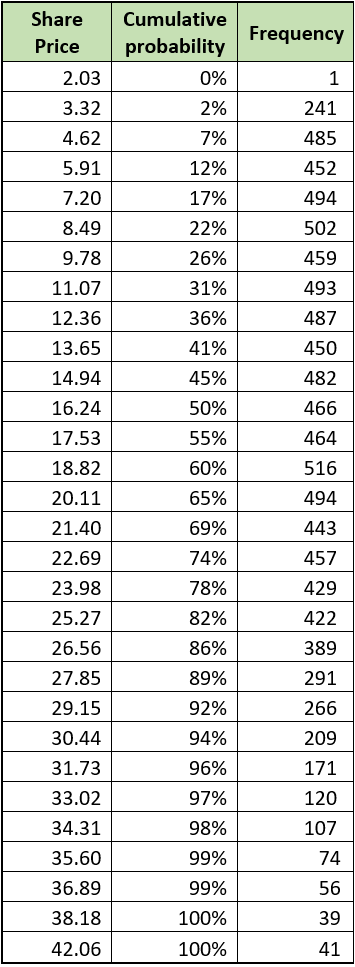

We then run 10,000 scenarios using a Monte Carlo simulation, to obtain our results.

Results:

In combining the two probability distributions above and running 10,000 Monte Carlo simulations, we get the below table.

As you can see, to get the share price of $9.78, IsZo would have to be successful only 26% of the time to justify paying that price. I.e. if you were to play this scenario 10,000 times in a row, and you had some special insider knowledge that IsZo chance of success was 26% (1 in 4) on average, then you should be willing to pay just under $9.78 for the shares, for you to expect to make money on average. Similarly if you think IsZo, success rate was 50%, then you should be happy to pay anything under $16.46 per share to make money on average.

E.g. if we knew that the probability of success for IsZo was greater than 26% we would love to buy shares at $9.78, since our Expected Present Value (EPV) will be positive.

If we were convinced that the probability of IsZo’s success is at least 50% say; then worse case, our EPV is ($16.24 – $9.78) = $6.46 gain, or an expected 66% appreciation in share price.

Now clearly no one knows what the true probabilities of IsZo’s success rates are. But having a reference point to see what probability the market is implying, can be helpful.

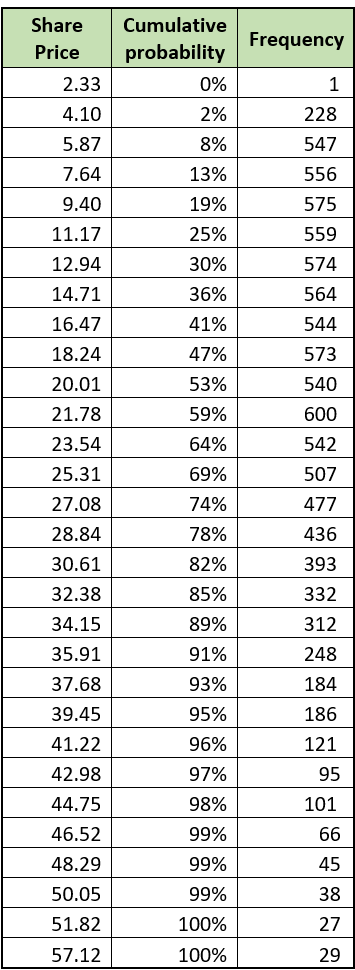

For reference, if you changed the Triangular distribution statistics to represent a realistic, but less conservative set of NAVs of (20,30,60), you get the following results table:

We find this situation volatile and binary, which means that position sizing is key. It might be tempting to use a rule of thumb, say 0.5% to 3% of portfolio for this kind of situation, or use the Kelly Criterion. Either way this is not an investment recommendation, and position size is key when dealing with situations where a bad outcome has significant downside.

Qualitative factors

Qualitative factors to combine with the above results, that we found helpful in considering what probabilities were in the range of reasonable and unreasonable, were:

The Chinese family that own Kaisa, and who IsZo are in battle with, are having liquidity problems with their own company, Kaisa. They can't pay off their own bond holders, have had corruption charges, and don't have great links with CCP (they backed Xi Jinping’s opponents). (Chinese Real Estate Developer Kaisa’s Debt Defaults Reflect CCP Infighting: Expert (theepochtimes.com) )

Yes, IsZo is not a native hedge fund, but they are highly motivated, have hired great lawyers, have a solid board selection including natives, and are in a make or break situation. They are heavily committed.

There is much more to it than that quick summary of qualitative factors, but for us we think those are key. And in combination with the probability analysis above, this has justified taking a small position in NTP.

Summary

We think it’s interesting to derive the expectations of the markets based on share price, to give a sense of whether it is being mis-priced. It is difficult for the human brain to hold both probabilities of success and balance it with asymmetric outcomes, and not get a biased non-risk averse assessment.

We believe this tool is helpful in such binary situations (downside is big and upside is even bigger), but not (as) useful when looking at a low downside situation, where there are often more impactful factors at play.

It is tempting to think of all the detail, e.g. informational advantages, other market participants, what if X assets are stolen etc; but in this situation we think that all those things on an individual basis are noise. They all add up to form the overall probability of outcomes, but create excessive fearful emotions when looked at individually. Therefore a probability based analysis is the most useful tool to us in this situation, as the most important thing to consider here, is whether there is a win or a loss.

This analysis is just one opinion and probably not a popular opinion. But hopefully it stimulates interesting conversations and thought.

The only other qualitative thing to highlight that hasn’t been discussed on other investment theses, is that Kaisa and the associated family, are not well liked by the local Chinese government. They are currently in a legal battle to keep control of their own company:

Disclaimer:

Nothing here is investment advice. Do your own due diligence. We will never give any investment advice on this website. We may choose not to update this idea in the future, so don’t count on us to provide updates. We welcome feedback good and bad. Thanks for reading!

Special Situations Global Equities has a small position in $NTP common stock.

Brought to you by twitter accounts @JoeValue and @Swapnil00456809. Follow us for more Special Sits content.

Appendix:

Background:

Updated background after forced selling:

Starting the year with some forced selling cleanup: $NTP (substack.com)