Background

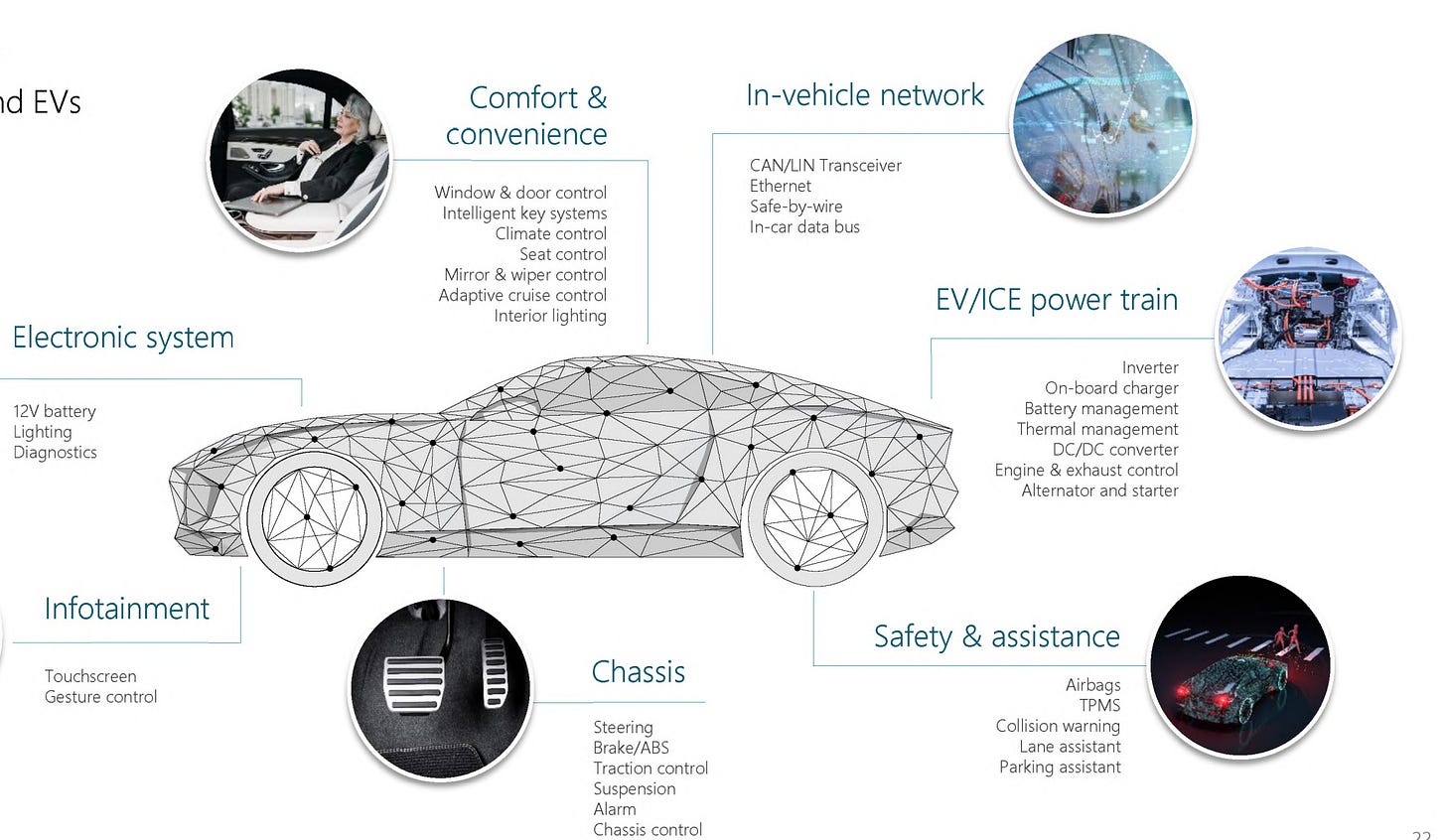

Simple thesis of buying a cyclical manufacturer of chips that go into Electric Vehicle (EV) production. Sentiment has been low recently and is now shifting.

Massive growth capex of $1bn has come to an end. I think it’s an easy one with low downside and high probability of 60%+ upside.

While sales of EVs has stalled recently in EU, it looks set to bounce back, and China is continuing on a roll.

In addition there was a large inventory build-up of chips in the industry which has nearly runoff.

All this points towards a new up cycle for a business at very cheap valuations, trading at 1x book value having just spent $1bn in growth capex, refurbing and expanding its production capacity ready for the next wave of demand.

The business is well run and looks to be in a great position to benefit from increases in volume. The business model is strong and margins will increase with volumes due to operational leverage.

Markets are already starting to price in the upward trend for this business, following a strong Q1 results and bullish earnings call. However I believe the fair value is a long way off and can see an easy 60% upside from currently levels on a prudent basis. With potential for much higher returns if growth is strong.

This is a case of buying a cyclical when it’s coming off it’s lows.

FYI there are better more detailed write-ups than this online, but I wanted to share with you why I bought this for my fund, and bring it to your attention so you can research it further.

It’s not an unknown business but certainly not as well known as ON 0.00%↑ ON Semiconductor for example.

So here it is…

Keep reading with a 7-day free trial

Subscribe to Special Situations Global Equities to keep reading this post and get 7 days of free access to the full post archives.