Special Situations Global Equities

Brought to you by @JoeValue and @Swapnil00456809

Date of Publish: 20/12/2021

The Company

Name: Atento SA (NYSE: ATTO)

Market Cap: $341m

Current share price $22.74

Executive summary

· Upside between 100% and 250%.

· Expected sale of business within 6 to 12 months

· Business turnaround plan clearly working

· Activist Investor now involved

About the business

Atento is the largest Customer Relationship Management (CRM) and Business Process Manager (BPM) outsourcer in Latin America. They effectively provide outsourcing services including, customer care, sales, technical support etc. Their largest market is Brazil (43%), with additional presence in North America and Europe.

Special Situation Detail

1. Turnaround

2. Sale of business

3. Activist Investor

Turnaround

ATTO is in the middle of a successful 3 year turnaround plan, with new CEO leading the charge since 2019. Margins are increasing and the company is profitable. All free cashflow is being reinvested into the strategic plan.

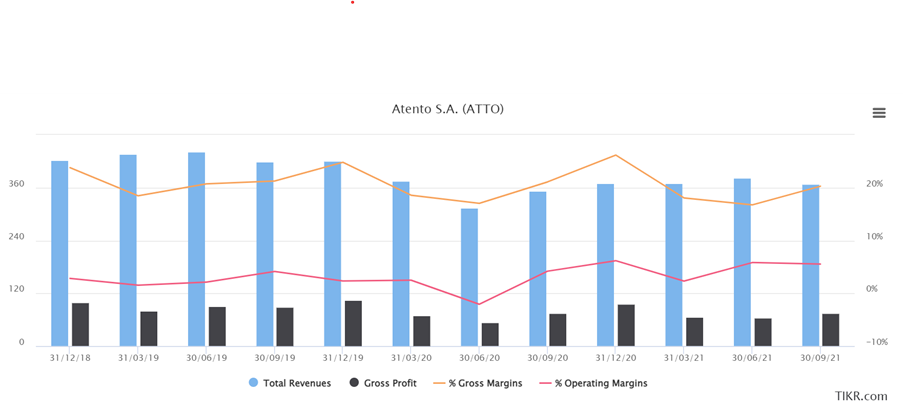

You can start to see the impact the turnaround is having on margins from the chart below:

Reason for Potential Sale

Atento has a complicated capital structure history. But keeping it simple, it was originally part of Telefonica and has ended up being majority owned by 3 investment firms HPS, GIC and Farallon who never wanted to own Atento.

HPS, GIC and Farallon (The Big 3) originally loaned the previous owners (Bain Capital) the money to keep a majority stake in the business. But due to Atento’s poor performance, Bain handed back the shares to The Big 3, that were being used as collateral, instead of repaying the loan. Now The Big 3 are focused on turning around the business and selling it to get their money back.

The Big 3 owners currently are unable to sell their shares until June 2022, when the lockup expires. However we expect that sometime in the next year these 3 owners will try to find a strategic buyer, which given the tight float is the only real way they can reclaim their capital that was originally a collateral backed loan.

Cost basis for the 3 owners is around $47. We think the business is worth at least $50 on a comparative and absolute basis. To a strategic buyer looking for growth and synergies, we expect the value is between $75 to $100. The likely eventual acquirer is Concentrix (CNXC), however shorter term it seems likely that a PE firm will pick ATTO up on the cheap and sell to CNXC at a later date, once ATTO turnaround is well matured.

A PE firm is likely to only want to pay up to a 50% premium to market price in most cases. So if the stock remains at low to mid $20s then the offer might be lower than is acceptable. However if enough investors spot this opportunity and can maintain a price of above $35, (which is still very cheap vs peers); then a PE firm should be able to offer a decent premium on top of that. Or a potential PE firm may just realise the value and be willing to offer a premium greater than 50%, since a low offer is likely to get rejected.

Who is the Activist Investor and what do they want?

Hedge fund Kyma Capital, based in the UK, has built up a 5% position recently. They nominated a new board member for Atento which was declined by the Big 3.

The most impactful argument Kyma makes, is that when The Big 3 investment firms took control of Atento, as a group owning more than 60% of the company, they acted in contravention of EU law. Kyma argues that the law mandates the new controlling owners to offer all shareholder $47 cash per share, the amount they paid for their controlling stake, at the time they took control. However the Board’s lawyers are arguing that the law doesn’t apply.

The upshot is, that after discussions between Kyma’s and Atento Board’s legal team, it will now be taken to the relevant authorities to resolve this issue.

We believe this narrows it down to three possible outcomes:

· $47 cash offer for all outstanding shares; or

· Will force Atento board into more active search for a buyer for the business to resolve this situation; or

· That Kyma have their board member nomination accepted, who fights for better governance and become a driving force for finding a buyer for the business.

Kyma has accused the board of a number of other corporate governance failures, particularly regarding poor public markets strategies, as well as the boards’ self-enrichment with over generous stock awards for the board members. They also appear to be only selecting board nominations that are part of the Big 3.

Kyma believes it is the boards’ fault that Atento is trading so cheaply compared to its peers.

Why does the opportunity exist?

It is a relatively illiquid Small Cap, with low analyst coverage and based largely in Brazil. This prevents larger investors from accumulating a meaningful position. There is also limited analyst following, so investor awareness is low.

Having a low float means that it doesn’t take that many investors to realise the current undervaluation, for it to quickly revert to nearer fair value.

Margin of safety

We always try to find asymmetric risk reward opportunities, where the upside is large and likely and downside is small and unlikely.

Given that the company is trading for ~ $23 and we believe on a conservative basis it’s worth more than $35, this gives us confidence that we are getting a good price for the business on an absolute basis, regardless of other upside potentials. The turnaround plan is clearly working and there is an upward trend in the industry overall.

In terms of comparative valuations, the average business in this industry is trading at ~15x EV/EBITDA, whereas Atento is trading at ~4.3x EV/EBITDA. Even with the ongoing turnaround and lower, but improving margins, this is clearly an undervaluation Vs its peers.

Therefore, if the strategic sale of the business doesn’t materialise, then we believe we’ve not paid a premium for this optionality. And we’ll be holding a strong and improving company, which in the long run should remain a sound investment.

Other risks include currency and wage inflation risk in Brazil. However these risk seem relatively immaterial given the current discount to fair value Atento is trading at.

Conclusion

· The turnaround is working very well, led by a strong management team

· It’s in an industry that’s in an upward trend

· A strategic sale of the business is very likely given the circumstances

· Activist Investor makes sale even more likely

· Downside is minimised given the current undervaluation of the company

· Upside is very high, in range of 100% to 250%, with low downside

· Potential for very high returns on an annualised basis, if sale happens soon

Notes

This is a brief summary intended to introduce the reader to the idea; however it lacks detailed analysis.

For those interested and to avoid repetition, we strongly recommend the excellent writeup by @PlumCapital $ATTO - Classic "Steak and Sizzle" Special Situation (substack.com)

Additionally I’d like to thank @BrownMarubozu who originally introduced us to the idea back in June 2021. He is extremely helpful and a font of knowledge for this situation.

Appendix

Link to email exchange between Kyma Capital and Atento:

https://www.dropbox.com/s/lj84e7ilci7akma/EXHIBIT%203.pdf?dl=0

Disclaimer:

Nothing here is investment advice. Do your own due diligence. We will never give any investment advice on this website. We may choose not update this idea in the future, so don’t count on us to provide updates. We welcome feedback good and bad. Thanks for reading!

Special Situations Global Equities is very long $ATTO common stock.

Brought to you by twitter accounts @JoeValue and @Swapnil00456809. Follow us for more Special Sits content.